Knowing how to buy stocks in Malaysia entails several aspects. Investors need to do their due diligence to minimize risk. So that involves knowing the right brokers to use, what to watch out for and selecting the most popular shares to watch right now in Malaysia in 2025.

Where to Buy Stocks in Malaysia in 2025

Investors have several options for choosing where to buy stocks in Malaysia.

1. Evest

Evest is a popular stock trading CFD (Contracts for Differences) platform and our top recommended way to buy stocks in Malaysia. With Evest, investors can trade more than 320 stock CFDs. The stocks have been handpicked from global markets, including the UK, the US, Asia, and Europe.

Evest is a popular stock trading CFD (Contracts for Differences) platform and our top recommended way to buy stocks in Malaysia. With Evest, investors can trade more than 320 stock CFDs. The stocks have been handpicked from global markets, including the UK, the US, Asia, and Europe.

Notably, Evest charges no commission on the buying and selling of stocks. Users can begin trading on Evest after completing a quick account creation process and making a minimum deposit. The minimum deposit differs per each available account type – namely, the Silver, Gold, Platinum, and Diamond accounts.

The Silver account lets one start trading after making only a $250 deposit (1064 MYR), while the Platinum and Diamond account have a high minimum deposit of $20,000 (85,160 MYR) and $50,000 (212,900 MYR), respectively. The Premium and Diamond accounts may benefit advanced traders since they offer lower spreads on trades.

Apart from direct stock CFDs, Evest offers ten investment baskets. Each basket contains promising assets which have been categorized together based on their performance in the past sixty trading sessions. This is considered a relatively low-risk investment opportunity.

Traders can also diversify their portfolios by adding different assets on Evest. This platform gives access to 525+ CFD assets, including stocks, cryptos, indices, and commodities. The Evest platform also lets members access the mobile app, which contains most of the tools as the proprietary platform. Available on iOS and Android, the mobile app has a 4.2 rating on the Apple website.

Evest also lets investors connect with MetaTrader 5, which gives one access to multiple analysis tools, price charts, and indicators. Beginner traders can access a demo account and increase their trading knowledge by reading educational materials from the ‘Trading Academy.’

The Vanuatu Financial Services Commission regulates this popular broker. While withdrawing funds, Evest members will be required to pay a $5 fee per transaction. However, there are no such fees on deposits.

Shares Available

320+

Pricing System

Spreads

Minimum Deposit

$250

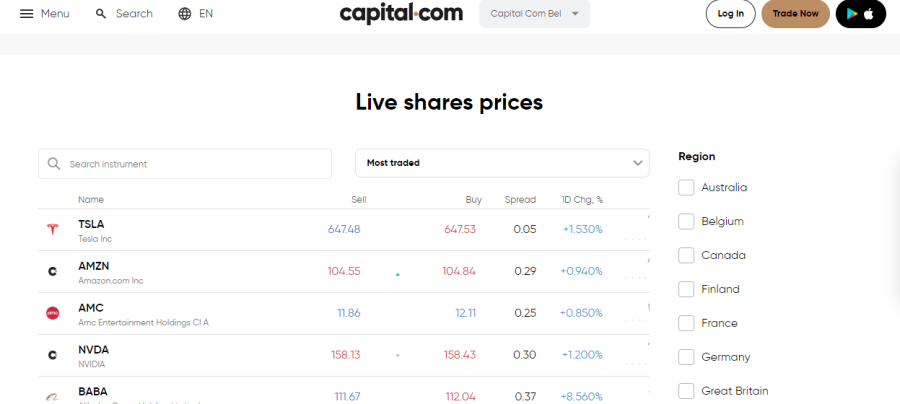

2. Capital.com

Capital.com has ensured that its platform caters to traders of all skill levels. Beginner traders can take advantage of the free tutorials on the platform, and pro traders can optimize their positions by combining indicators and strategies.

has ensured that its platform caters to traders of all skill levels. Beginner traders can take advantage of the free tutorials on the platform, and pro traders can optimize their positions by combining indicators and strategies.

Traders will also benefit from zero charges for deposits and withdrawals. Traders pay the bid/ask spread to the broker, and fees for trades open overnight may also apply to certain assets.

Pro traders can use the 1:5 leverage. Using leverage is risky, so beginner traders should know that their losses are multiplied by 5 if the trade goes against them. Conversely, they will make five times more if the trade turns favorably. But leverage trading is extremely risky, and traders should be careful.

As well as stocks, cryptocurrency and forex trading is also supported for Malaysia based traders.

Traders who are uncertain about how leverage works or want to test out Capital.com’s platform can do so by downloading a free demo account. If investors get stuck, they can also contact the 24/7 support.

It’s important that brokers are held to high ethical standards, and that’s the case with Capital.com. Financial bodies regulate brokers such as Capital.com to ensure they don’t mismanage funds, so it was nice to see that Capital.com is regulated by FCA, FSA, CySEC, ASIC and NBRB. This platform also provides one of the crypto wallets in Malaysia.

| Shares Available | 5000 |

| Pricing System | 0% commission, only bid/ask spread |

| Minimum Deposit | $20 |

3. eToro

The first thing that investors need to consider when choosing a broker is if it’s regulated. eToro is serious about showing investors that it upholds high financial standards by being regulated by FCA, ASIC, FINRA, CySEC and even the US SEC.

The first thing that investors need to consider when choosing a broker is if it’s regulated. eToro is serious about showing investors that it upholds high financial standards by being regulated by FCA, ASIC, FINRA, CySEC and even the US SEC.

Beginner investors can place a trade conveniently as the platform navigates them, but advanced traders can use indicators and advanced tools. eToro has a mobile trading app that contains the same features on the desktop but is convenient for a mobile screen.

To start trading on eToro, Malaysian investors need to deposit at least $50. If the deposit is in a currency other than USD, investors will incur a conversion fee of 0.5%. Payment options to fund the account include bank wires, cards, Paypal, Yandex, Skrill, Neteller and many others. Traders wishing to withdraw funds will incur a $5 fee.

Opting to buy shares in 2025 on eToro means having access to more than 2,980 stocks on 17 exchanges. This platform enables investors to buy fractional stocks and trade 15 indices and 264 ETFs. On top of that, eToro offers CopyTrading and CopyPortfolios.

Beginner investors wishing to trade the same as pros can copy their trades by using CopyTrading. Fees aren’t applicable to open a trade but overnight fees may apply. Investors can diversify their portfolios by opting for CopyPortfolios.

| Shares Available | 2980 |

| Pricing System | 0% commission, only bid/ask spread |

| Minimum Deposit | $50 |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

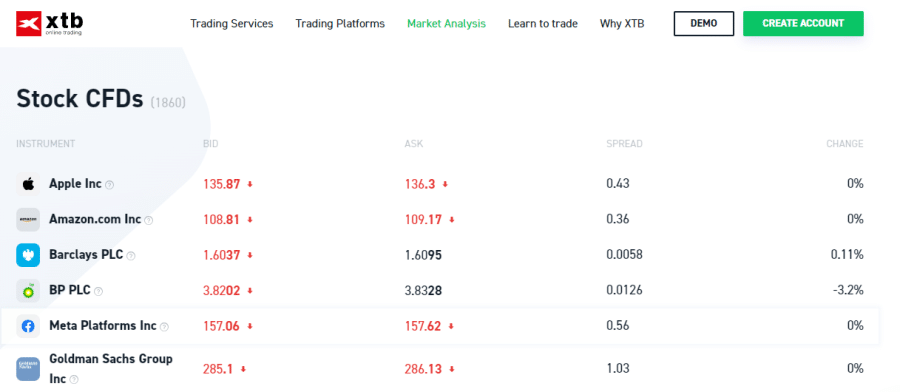

4. XTB

Investing on XTB enables traders access to 2,100 instruments in global markets. A mobile app is available on Android and iOS. XTB is a CFD specialist, and traders will have access to more than 1,860 equities on its desktop platform called xStation 5. Otherwise, investors can also trade indices, ETFs and commodities.

Investing on XTB enables traders access to 2,100 instruments in global markets. A mobile app is available on Android and iOS. XTB is a CFD specialist, and traders will have access to more than 1,860 equities on its desktop platform called xStation 5. Otherwise, investors can also trade indices, ETFs and commodities.

Getting started on this platform is simple because XTB doesn’t have a minimum deposit requirement. Malaysian investors have various options to fund their accounts such as bank wires, cards, Neteller and Skrill. No fees are applicable to depositing via bank transfers and cards. Skrill deposits are 2%, and Neteller deposits are charged 1%. Investors don’t incur fees for withdrawals above $50.

Investors will be glad to know that trading on this platform is commission-free. But inactive traders are charged €10 monthly after 12-month inactivity.

Security is of the utmost importance to investors to ensure their funds are safe, so XTB is licensed and regulated by Financial Conduct Authority.

| Shares Available | 1860 |

| Pricing System | 0% commission, only bid/ask spread |

| Minimum Deposit | $0 |

5. Passfolio

Investors who are wondering how to buy stocks can do so on Passfolio. This broker is available in 170 countries, and it offers more than 6,000 stocks for trading on its platform. Traders who prefer to use their phones can download the Passfolio app on iOS and Android. The same desktop features are available on the app.

Investors who are wondering how to buy stocks can do so on Passfolio. This broker is available in 170 countries, and it offers more than 6,000 stocks for trading on its platform. Traders who prefer to use their phones can download the Passfolio app on iOS and Android. The same desktop features are available on the app.

Investors have several options to fund their accounts. International debit cards, bank wires, ACH and US checking accounts are some of the options. Other available options are Revolut and Transfer, which are free. Funding an account with cards comes with a 5% fee. Traders wishing to withdraw funds will incur a $35 fee. Passfolio enables traders to 0% commission for the first 10 monthly trades. After that, the platform charges a 0.25% commission.

If investors don’t wish to day-trade, they can invest in a Smart Portfolio. That enables them to diversify their portfolios by investing in several stocks. A 0.75% annual management fee applies to investing in a Smart Portfolio.

When determining how to buy shares in Malaysia, investors must seek regulated brokers. Passfolio is a regulated broker. Investors will be glad to know that Passfolio has ensured investor equity accounts for up to $500,000. Passfolio is also a FINRA member and FDIC insured for up to $250,000.

| Shares Available | 6000 |

| Pricing System | 0% commission for first 10 trades, then 0.25% commission |

| Minimum Deposit | $0 |

6. TD Ameritrade

One of the things that appeal to many traders about TD Ameritrade’s platform is that it offers several versions. Choosing the right platform depends on each trader’s needs. Besides offering a standard desktop version, TD Ameritrade also enables traders to download an app and a thinkorswim version. Each of these platforms contains distinct features. Traders can use free education material on this platform to educate themselves about trading.

One of the things that appeal to many traders about TD Ameritrade’s platform is that it offers several versions. Choosing the right platform depends on each trader’s needs. Besides offering a standard desktop version, TD Ameritrade also enables traders to download an app and a thinkorswim version. Each of these platforms contains distinct features. Traders can use free education material on this platform to educate themselves about trading.

Investors wanting to fund their TD Ameritrade account can do so via a bank transfer, check or ACH. Doing a transfer via bank or check doesn’t contain a minimum amount, but ACH deposits are $50 or more. Investors wondering how to buy US stocks in Malaysia can do so without a commission online and trade 3,500 equities.

However, TD Ameritrade also enables investors to open trades via IVR phone system, which incurs a $5 fee. Traders can also place trades via the broker-assisted option, but it costs $25 per transaction. This platform also enables over-the-counter (OTC) stock trading, which comes with a $6.95 commission.

| Shares Available | 3500 |

| Pricing System | 0% commission |

| Minimum Deposit | $0 |

7. Alpaca Trading

Investors who want to know how to buy foreign stocks in Malaysia can use Alpaca Trading. This platform enables investors to use API for algorithmic trading of equities and ETFs. As always, we make sure that a broker is regulated, so we’re happy to report that Alpaca Trading is a member of FINRA and SIPC. Since it’s a SIPC member, Alpaca has provided securities protection of up to $500,000.

Investors who want to know how to buy foreign stocks in Malaysia can use Alpaca Trading. This platform enables investors to use API for algorithmic trading of equities and ETFs. As always, we make sure that a broker is regulated, so we’re happy to report that Alpaca Trading is a member of FINRA and SIPC. Since it’s a SIPC member, Alpaca has provided securities protection of up to $500,000.

If investors feel that API algorithmic trading is a foreign topic to them and are uncertain about the platform, they can download it and test it out in the sandbox environment, which is like a demo account. While in the sandbox environment, traders can try out the margin leverage. During intra-day trading, the platform enables 4x leverage, but overnight trading is exposed to 2x leverage.

Traders who want to trade pre and after-market can do so on Alpaca Trading. The pre-hours are from 4 am to 9:30 am ET. After-hours trading is from 4 pm to 8 pm ET. During normal hours, the platform enables traders to choose from 8,000 stocks. No minimum amount for deposits applies and trading is commission-free.

| Shares Available | 8000 |

| Pricing System | 0% commission, only bid/ask spread |

| Minimum Deposit | $0 |

8. Easy Equities

Beginner traders who want a simple platform that enables them to open positions conveniently will enjoy Easy Equities. Easy Equities has provided a demo account for beginners to practice if they want to incorporate advanced tools.

Beginner traders who want a simple platform that enables them to open positions conveniently will enjoy Easy Equities. Easy Equities has provided a demo account for beginners to practice if they want to incorporate advanced tools.

Depositing funds into an Easy Equities account is possible via several options such as bank transfers, cards and EasyFX. The platform charges 2.3% transaction fees for cards and 0.5% for EasyFX. Transferring money via SWIFT will result in a minimum fee of $10. As for trading, Easy Equities charges a 0.25% commission. Since this platform wants to accommodate traders of all budgets, it has enabled them to buy fractional shares.

| Shares Available | 100+ |

| Pricing System | 0.25% |

| Minimum Deposit | $1 |

9. UTrade

Investors asking themselves how to buy shares online in Malaysia may opt for UTrade. This platform is for traders of all skill levels because it provides news and signals for pro traders and education for beginners. Investors new to trading can attend seminars hosted by UTrade and use its convenient platform. Besides stock alerts, pro traders can also use tools such as StockScreener, TechAnalyzer and ChartGenie.

Investors asking themselves how to buy shares online in Malaysia may opt for UTrade. This platform is for traders of all skill levels because it provides news and signals for pro traders and education for beginners. Investors new to trading can attend seminars hosted by UTrade and use its convenient platform. Besides stock alerts, pro traders can also use tools such as StockScreener, TechAnalyzer and ChartGenie.

Funding an account with UTrade is possible via checks, EPS, PayNow, GIRO and bank wire. It’s possible to fund accounts with GBP, EUR and CAD. Malaysian traders will pay 0.50% transaction fees up to RM100,000, then fees lower to 0.4% between RM100,00 and RM200,00. Investors who have a UTrade Edge Account will pay 0.12%. This platform also charges a clearing fee of 0.03%, a stamp duty of 0.1% and a 6% sales and service tax.

| Shares Available | 100+ |

| Pricing System | 0.5% |

| Minimum Deposit | $2000 |

Regulated Malaysia Stock Brokers Compared

The table below compares some of the trading features among the best stock brokers in Malaysia.

| Stock Brokers | Shares Available | Pricing Structure | Minimum Deposit | Payment Methods |

| Evest | 320+ | 0% commission | $250 | Wire transfer/credit cards, Skrill, Neteller, Maestro |

| eToro | 2980 | 0% commission | $50 | Bank wire, cards, Skrill, Paypal, Neteller, Yandex |

| Capital.com | 5000 | 0% commission | $20 | Bank wire, cards, Sofort, Ideal, ApplePay |

| XTB | 1860 | 0% commission | $0 | Bank wire, cards, Neteller, Skrill |

| Passfolio | 6000 | 0% for first 10 monthly trades, then 0.25% | $0 | US checking account, international debit cards, ACH, Transfer, Revolut |

| TD Ameritrade | 3500 | 0% commission | $0 | Wire transfer, ACH, check |

| Alpaca Trading | 8000 | 0% commission | $0 | Bank wire, credit cards |

| Easy Equities | 100 | 0.25% commission | $1 | Bank wire, cards, ACH, EasyFX, Swift |

| Utrade | 100+ | 0.5% commission | $2000 | Bank wire, checks, EPS, NowPay, GIRO |

9 Popular Stocks to Watch Now in Malaysia

Here are 9 popular stocks that some analysts and traders are paying close attention to in 2025

1. Walmart

In an industry where giants such as Sears and Toys R Us have closed their doors, Walmart is leading not only the retail industry but all industries. In the Fortune 500 ratings of the biggest companies in the world, Walmart beat powerhouses such as Amazon and Apple.

In its last quarterly earnings report in October 2022, Walmart’s earnings were up by 8.74% Year-on-Year (YoY). Walmart’s impressive earnings are one of the reasons that its stock has climbed over the last decade and reached an all-time high (ATH) of $160 in April 2022. Currently, the stock price of Walmart is $140.

2. Exxon Mobil

Exxon Mobil has more than 64,000 employees and was the sixth highest-earning company in 2021. The company earned approximately $55.7 billion in 2022, compared to the $23 billion it earned in 2021. The revenue has been generated from several income streams, such as the production of crude oil and natural gas.

In its last quarterly financial report in September 2022, Exxon Mobile was up 47% on YoY earnings. This company also has. current dividend payout of 3.26%. Exxon Mobile is currently trading at $11 per share.

3. Meta Platforms

Formerly known as Facebook, Meta Platforms Inc. is the leading social media company in the world. Not only does the company have almost 3 billion users on Facebook, but it also owns popular sites Instagram and chat platform WhatsApp. And now, Meta is also expanding to virtual gaming and cryptocurrency.

Investors who bought shares in this company in 2013 earned returns of more than 1,500% when the stock reached an ATH of $383 in September 2021. Currently, Meta is trading at $186 per share.

4. PayPal

Founded by Peter Thiel, Paypal has been one of the biggest payment platforms in the world. Paypal is in 200 countries and has more than 426 million users. Paypal has even gotten into crypto. Users can buy Bitcoin and other major cryptocurrencies on the platform. This platform usually charges 4% transaction fees, so it’s no wonder that it generated $25 billion in revenue in 2021.

PayPal reported a 10.74% YoY earning increase for Q3 2022. Currently, PayPal stock is trading at $82.

5. Coinbase

The crypto market is expanding rapidly, and when Coinbase had its initial public offering (IPO) in April 2021, it cemented its position as one of the popular cryptocurrency exchanges. The stock did well during the IPO, but it started falling thereafter.

Currently, Coinbase is trading at $74.5 per share. This is 78% below its ATH of more than $340.

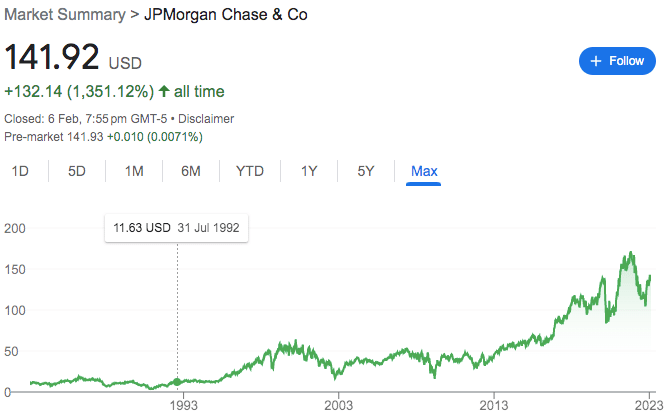

6. JP Morgan Chase

JP Morgan Chase is one of the biggest banks in the world, with a 2021 turnover of $124 billion. In 2022, the revenue increased to $154 billion, over a 21% increase from 2021.

Proving to be a valuable stock in the long term, JP Morgan Chase is trading over 1,340% higher since it went public. Currently, the stock price is $141.

7. Apple

Apple was the first company to reach a market cap of $3 trillion. It’s currently the biggest company in the world by market cap, with just over $2.4 trillion. This technology company has become a global leader with its mobile phones, laptops, tablets and has even ventured into streaming services. Apple TV+ is set to compete with platforms such as Netflix and Amazon Prime.

Apple is currently trading at $151 per share. This company has also generated a whopping 72,152% return on investment since the stock went public in 1983.

8. AmBank

AmBank Group is one of the largest banking groups in Malaysia offering retail banking, wholesale banking and general insurance. It was founded in 1975 and employs more than 10,000 people. In 2019, a proposed merger between RHB Bank and AmBank Group surfaced, with talks ongoing for several years, but no progress has been made.

AmBank generated a 33% earnings increase in Q3 2022. Currently, the stock is priced at 3.97 MYR ($0.92).

9. Shell

Shell is one of the biggest companies in the UK, producing energy products such as oil, fuel and natural gas. More than 87,000 people are on the company’s payroll and are located in 70 countries. Shell’s stock price had been in a massive range since 1999, then broke out of the range in 2020.

In the past 12 months, the Shell price is up by more than 17%.

Are Shares Taxed in Malaysia?

Taxes on shares is a major concern for investors after they’ve decided what stocks to watch now in Malaysia. Capital gains on shares aren’t taxable in Malaysia. The Malaysian government hasn’t imposed taxes on profits or gains from price increases when investors sell stocks.

Conclusion

Our guide has discussed in depth how to buy stocks in Malaysia. We have also provided information about how to research dividend stocks in Malaysia and highlighted some popular share trading platforms in Malaysia. We recommend Evest as the best stock trading platform in Malaysia.

Investors can access this trading platform to trade over 320 stock CFDs. Evest lets traders access multiple account types and trade stocks without any commission.